Is it worth financing a photovoltaic installation?

Although the choice depends on many factors and is unique to each project, financing or renting has some advantages:

- It allows starting the project without having to advance the total cost of the installation.

- The payments can be covered with the monthly savings from the installation.

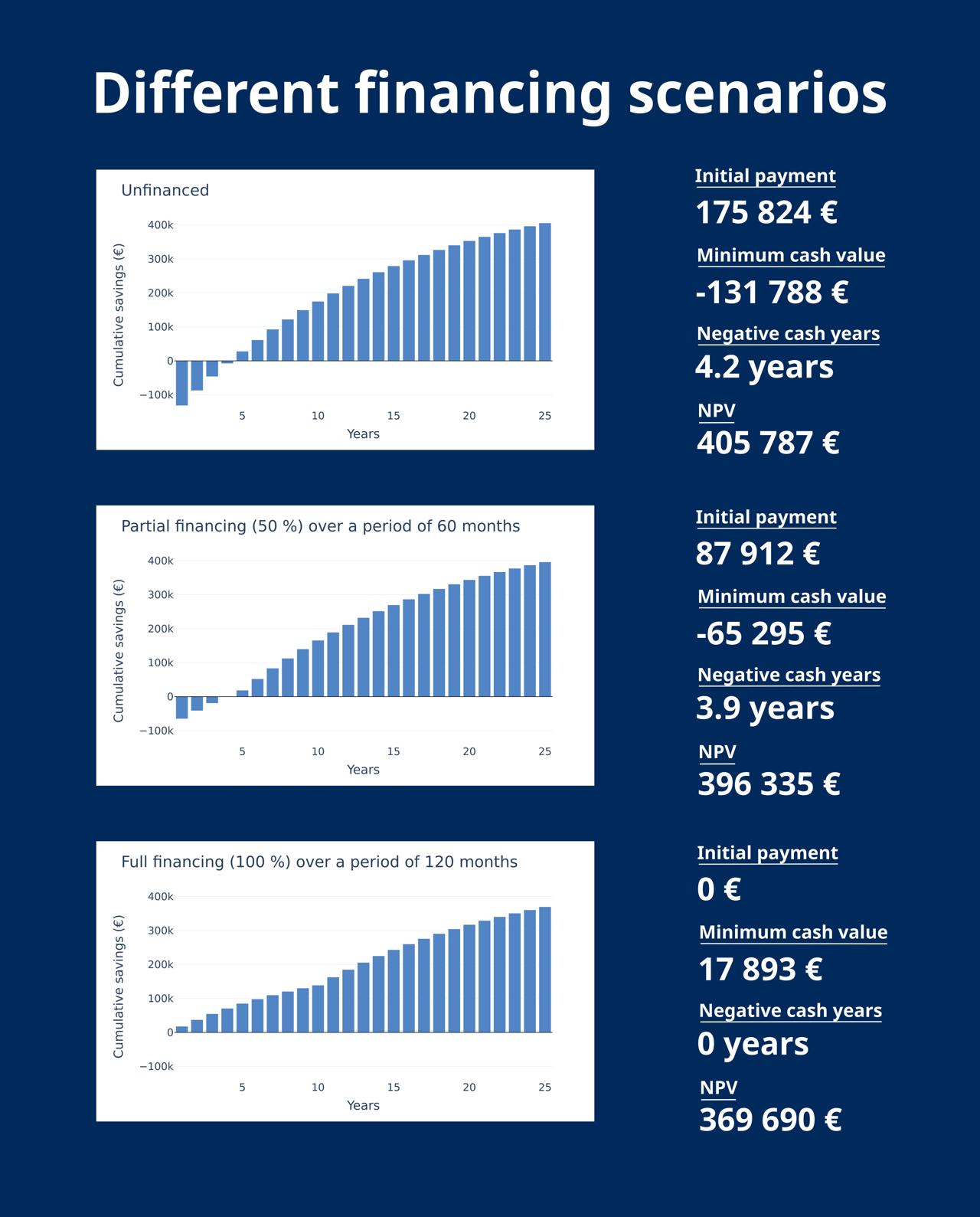

To explain it with a practical case, in the image, you can see the results of a study for a 244.2 kWp project with a cost of €175,824 and 3 financing scenarios (more details in the first comment):

1️⃣ Without financing, the maximum NPV or cumulative profit is obtained (€405,787), with a payback period of 4.2 years.

2️⃣ With partial financing of 50% over 5 years, the initial investment is halved, and the payback period is reduced by ~4 months, although at the same time, the NPV is reduced by ~€9,500.

3️⃣ With total financing over 10 years, no initial outlay is required, and as the savings exceed the monthly payments, the cash flow is always positive (although the NPV is further reduced).

This, of course, is not always the case for all projects. There may be cases where the cash flow is not always positive for 100% financing, or where the savings do not exceed the monthly payments for partial financing.

🏦 Indicators such as the IRR or the NPV can help your client better understand the profitability of the investment and decide whether they want (or can) execute it with a single initial payment or if they prefer to resort to financing or renting.

In all cases, the client obtains the same photovoltaic installation and energy independence from the grid. 🚀