Europe’s solar landscape in 2025: a semester of light and shadows

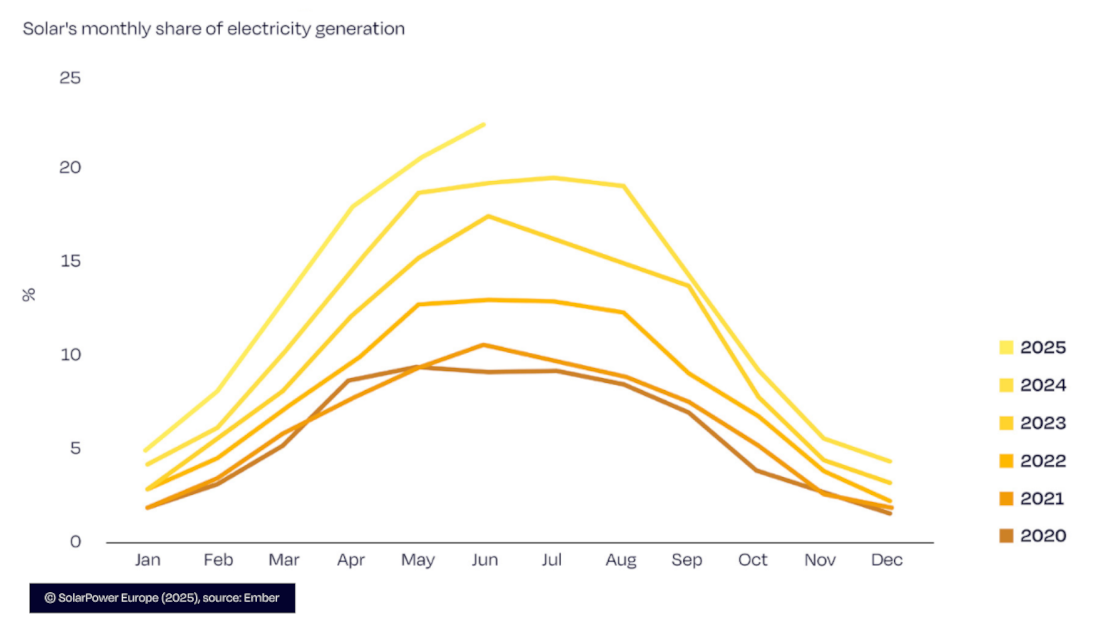

The first half of 2025 will go down in Europe’s energy history: for the first time ever, solar became the leading source of electricity, covering 22.1 % of the EU’s power mix and generating 45 TWh in June alone, according to the EU Market Outlook for Solar Power – 2025 Mid-Year Analysis, published by SolarPower Europe.

Is this a sign that the energy transition is progressing? Perhaps — but it also suggests we’re entering a new phase.

Challenges and opportunities defining the current situation in Europe

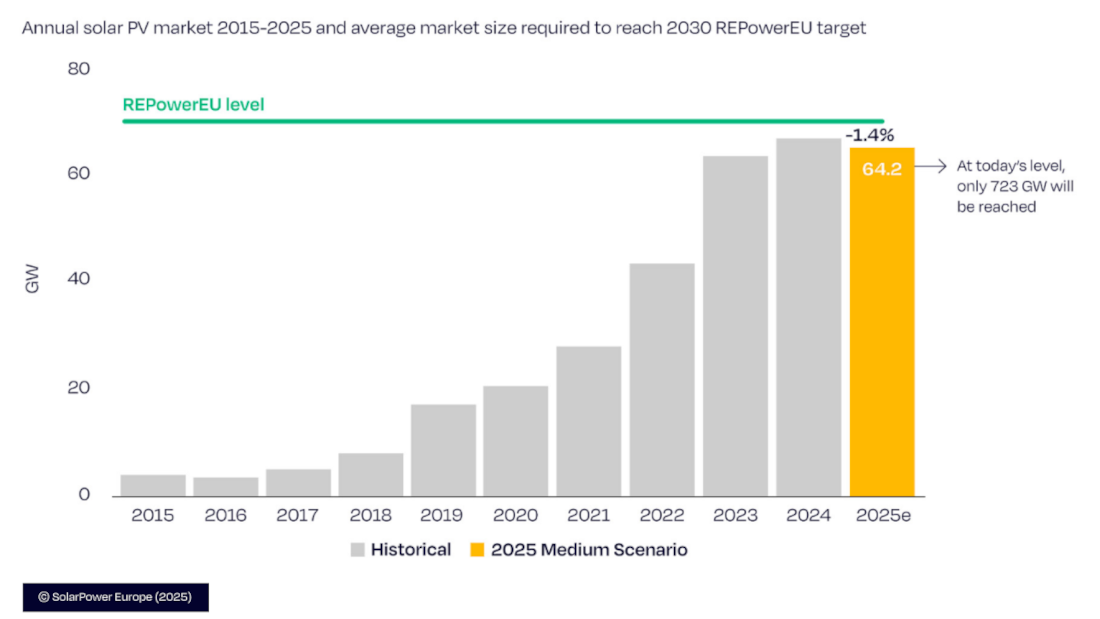

⏸️ Stagnation: after surging 47 % in 2022 and 51 % in 2023, the European solar market grew by just 3.3 % in 2024 (from 62.2 GW to 64.2 GW). Projections for 2025 even suggest a slight contraction of –1.4 %, with just 63.3 GW expected to be deployed.

🎯 Target: to reach the 750 GWDC target by 2030, the EU would need to install 69.6 GW annually. At the current rate, we would only reach 723 GW, according to the central scenario forecast in the SolarPower Europe report.

🏘️ Rooftop PV: rooftop residential installations, which accounted for 30 % of new solar capacity in 2021, have dropped to just 15 % in H1 2025. Germany, the Netherlands, Poland, and Austria are among the countries contributing most to this downturn.

📉 Corporate PPAs: corporate power purchase agreements for solar fell by 41 % year-on-year in Q2 2025, affected by spot market uncertainty and declining prices.

🔋 Storage: battery storage is expected to grow by 52 % this year, reaching 75 GWh of cumulative capacity across the EU.

Country-by-country solar snapshot

🇩🇪 Germany: according to data from the Marktstammdatenregister (MaStR) register and sector reports, Germany exceeded one million plug-in solar panels in mid-2025, after registering more than 700,000 in October 2024 and an additional 300,000 in 2023.

🇪🇸 Spain is leading in utility-scale deployments, but facing negative prices and grid inflexibility.

🇮🇹 Italy saw strong growth in 2024 but is expected to contract by 12 % in 2025 due to territorial and regulatory constraints.

🇫🇷 France: the commercial rooftop segment tripled in H1 2025 compared to the same period in 2024, but the government is sending somewhat contradictory regulatory signals.

🇵🇱 Poland: solar deployment is expected to drop by 15 %, affected by curtailment measures and self-consumption regulations.

🇳🇱 Netherlands: still a leader in watts per capita, but showing signs of decline due to the phase-out of net metering.

🇵🇹 Portugal: although not highlighted in SolarPower Europe’s report, its solar potential is undeniable. The country has made notable progress in utility-scale projects and represents an opportunity for distributed storage and energy communities.

🇭🇺 Hungary is one of the few EU countries with a projected net increase in installed solar capacity in 2025, in contrast to the general trend of stagnation. While exact figures are not available, steady growth is expected, particularly in the residential and commercial segments.

🇫🇮 Finland is experiencing spectacular growth. It is expected to increase its solar capacity fivefold in two years.

🇸🇪 Sweden, 🇧🇪 Belgium and 🇬🇷 Greece are showing signs of slowdown, largely due to regulatory changes or subsidy withdrawals.

Europe’s solar future is not just about installing more panels — it’s about managing solar intelligently: when it’s produced, when it’s needed, where it’s stored, and how it’s shared.

At ieco, we remain committed to a future in which energy is cheap, clean, accessible and distributed, and we continue to grow in order to meet these challenges and opportunities.

Will Europe achieve the targets set for 2030? 🚀😊